DEFRA announces indicative base fees for extended producer responsibility (EPR) scheme

“The Department for Environment, Food and Rural Affairs (Defra) has released the first indicative base fees for extended producer responsibility (EPR) scheme for packaging, which will come into effect in 2025.

The EPR scheme seeks to make those who introduce packaging into the market responsible for its entire lifecycle, ensuring that product design incorporates considerations for disposal and recycling.

The base fees will apply to obligated packaging producers and will be administered by the Scheme Administrator (SA). Fees will be additional to charges imposed by environmental regulations across the UK, and the costs of meeting packaging recycling targets.

The 2025/26 base fee rates vary depending on the material.

- Aluminium packaging fees range between £245 and £655 per tonne.

- fibre-based composites between £410 and £655 per tonne.

- paper or board between £185 and £350 per tonne.

- plastic between £355 and £610 per tonne.

- steel between £170 and £420 per tonne.

- wood and other materials range from £225 to £330 per tonne.

- Glass fees, calculated using a separate methodology, are estimated to be between £130 and £330 per tonne.

Defra has emphasised that these base fees are only preliminary estimates and are subject to change as more data becomes available. Producers are cautioned against using these figures to determine worst or best-case scenarios due to uncertainties in the data.

The Government is set to release updated base fees next month after data verification. Data reporting deadlines are set for 1 April each year, meaning that the exact fee rates for the first EPR year (2025/26) will not be finalised until after April 2025.

Many industry players have welcomed the news for providing much-needed certainty and clarity on a policy first touted in December 2018. However, glass businesses have expressed concern over the potential negative impact on their sector due to the weight-based fee structure.”

Department for Environment, Food & Rural Affairs – GOV.UK (www.gov.uk)

Whilst paper may appear the lower cost option over say plastic one should also remember paper grammage per square metre and factoring in performance characteristic requirements may still be more costly in the round.

These modulated fees will be in addition to Packaging Recovery Notes (PRNs) which are purchased by “obligated producers” to prove that they have recycled and recovered packaging materials. These producers include businesses such as supermarkets and manufacturers, but charities are not obligated to buy PRNs. The number of PRNs a business must purchase is determined by the amount of packaging they place on the UK market and the recycling target for those materials.

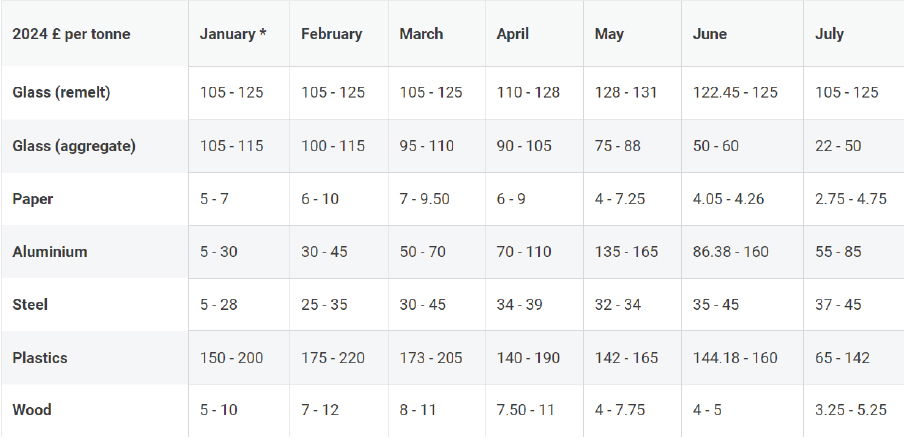

Indicative Packaging Recovery Note (PRN) values do vary significantly as illustrated in the table below, based on classic supply / demand dynamics.

Let’s also not forget the plastics tax of £217.85 per tonne on virgin plastic or plastic with less than 30% recycled content. This increases annually with inflation.

Whilst all the mentioned initiatives are designed to influence businesses there is also a Deposit Return Scheme (DRS) coming down the tracks to influence consumer behaviour. A plastic and possibly glass bottle and can recycling system that encourages consumers to return single-use containers for recycling by charging a small refundable deposit when they purchase a drink. The deposit is refunded when the consumer returns the empty container to a collection point, such as a return vending machine (RVM) or manual handheld scanning readers.

Now it would seem we have a financial model to fund packaging waste moving forward assuming that all the monies raised are directed to packaging end of life scenarios e.g. physical or chemical recycling in a circular economy.

We should expect to see further commercial incentives from government on packaging materials in the coming years related to carbon emission reductions / carbon net zero initiatives.

This all looks complicated, and it is, software solutions will be required to capture the granular data, that needs calculating accurately and reported transparently year on year by authentic third parties as no one trusts the marking of one’s own homework.

It is now time to rethink ones Enterprise Resource Planning (ERP) software solutions / plug ins, as has been done for finance in the past. As wherever there is a financial cost there will be a carbon footprint.

Recent Posts

- European Parliament Votes to Postpone Corporate Due Diligence and Sustainability Reporting Requirements

- Financial Markets vs. Sustainability Markets in Packaging

- How prepared are you for the Packaging and Packaging Waste Regulation (PPWR)?

- Green Claims Regulation: A Global Perspective on Environmental Marketing

- The Environmental and commercial Impact of Packaging (Facts, Figures and a solution)

Recent Comments